Automate Financial Operations Through Connected Banking Systems

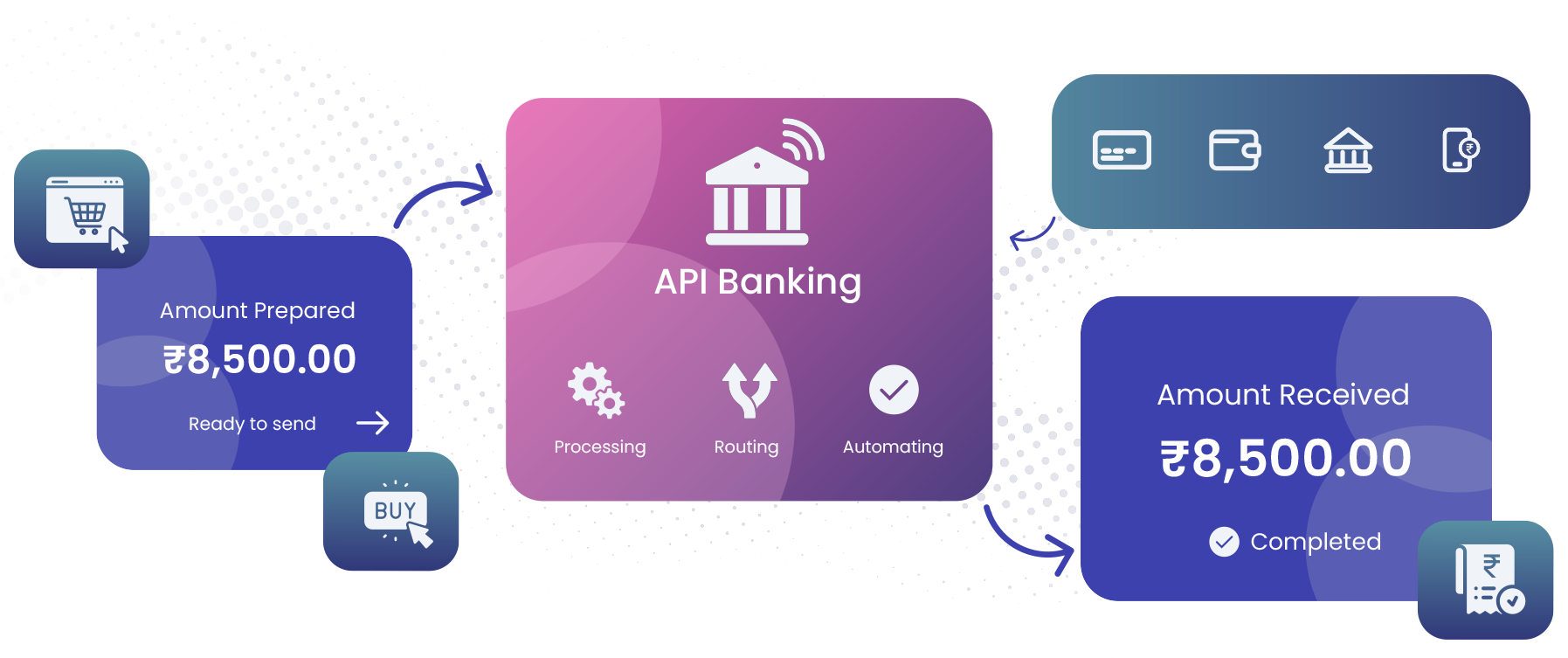

API Banking enables software-driven access to banking functions, allowing businesses to automate payouts, collections, reconciliation, reporting, and account actions.

Link your platform with banking functions using authenticated endpoints, permissions.

Define payout logic, approvals, limits, and conditions guiding automated movements.

Initiate payouts, collections, and account operations programmatically based on workflows.

View balances, transaction statuses, and reports through dashboards, system responses.

Automate recurring banking tasks to reduce delays, improve accuracy, and efficiency.

Streamlined Operations

Automate routine banking actions for faster, error free processing.

Access real-time balances, transaction updates, and reports for better decision making.

Clear Financial Insights

View live balances, activity updates and summaries instantly.

Support transaction volumes and complex workflows without increasing manual processes.

Flexible Workflows

Handle growing transactions, loads without added manual effort.

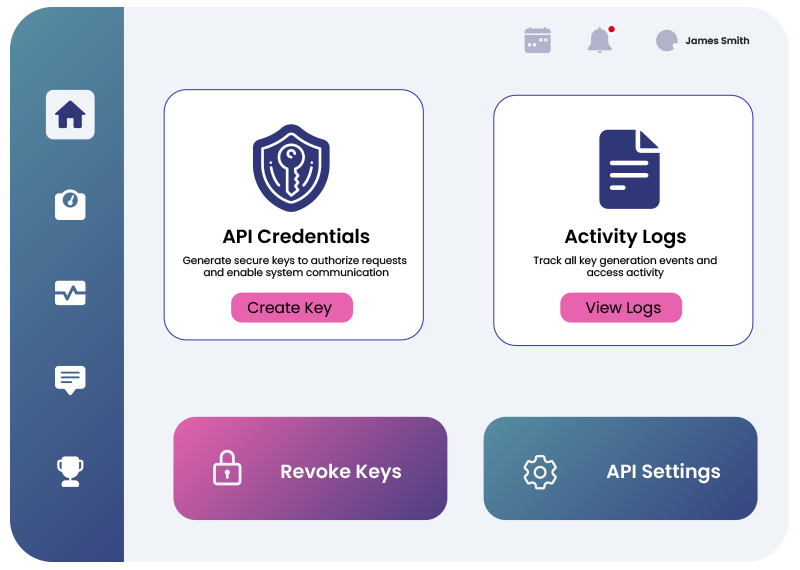

Simple Steps For Payment API Integration

Create keys from the dashboard to authenticate requests and enable authorized communication between your systems.

Review available endpoints, request formats, response structures, and error handling before beginning development work.

Implement server-side logic to trigger collections, settlements, and account actions within defined workflows efficiently and consistently.

Validate responses, monitor callbacks, and move integration to live environment after successful testing and approval readiness.

Follow a structured approach to connect payment capabilities with your platform using documented endpoints and credentials.

Understand the Flow Behind API Banking

Optimized For Business Process Automation

Reduce manual effort by automating banking workflows and improving processing speed across daily financial operations activities.

Gain clear insight into balances, transactions, and system responses for informed financial planning decisions across teams.

Start the payouts, collections, and account actions instantly through system driven instructions without delays or manual intervention.

Minimize errors by replacing manual processes with rule based automated banking operations that ensure consistency always.

Support growing transaction volumes and evolving workflows without rebuilding systems or increasing operational complexity over time.

Maintain flexibility through configurable endpoints, permissions, and logic tailored to specific business requirements across platforms.

Minimize errors by replacing manual processes with rule based automated banking operations that ensure consistency always.

Support growing transaction volumes and evolving workflows without rebuilding systems or increasing operational complexity over time.

Maintain flexibility through configurable endpoints, permissions, and logic tailored to specific business requirements across platforms.

Minimize errors by replacing manual processes with rule based automated banking operations that ensure consistency always.

Support growing transaction volumes and evolving workflows without rebuilding systems or increasing operational complexity over time.

Maintain flexibility through configurable endpoints, permissions, and logic tailored to specific business requirements across platforms.

Minimize errors by replacing manual processes with rule based automated banking operations that ensure consistency always.

Support growing transaction volumes and evolving workflows without rebuilding systems or increasing operational complexity over time.

Maintain flexibility through configurable endpoints, permissions, and logic tailored to specific business requirements across platforms.

.avif)

.avif)

.avif)